Big policy shifts reinforce higher rates

U.S. tariffs and Europe boosting fiscal stimulus reinforce our view of policy rates staying higher versus pre-pandemic levels. We go underweight euro area bonds.

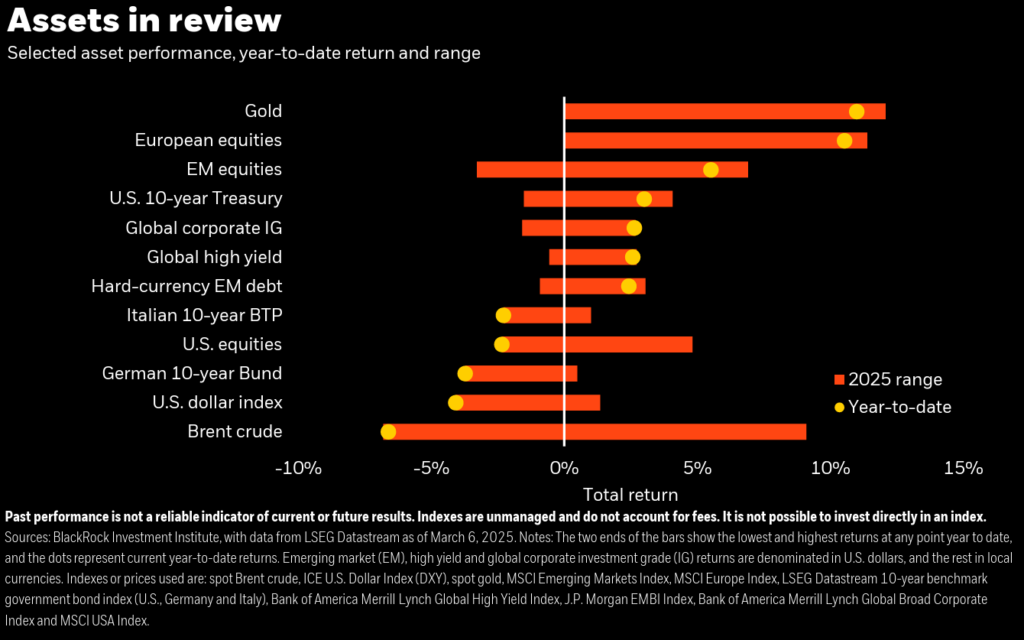

U.S. stocks slid 3% last week on market concerns about policy uncertainty. German bond yields jumped the most since 1990 on big fiscal spending plans.

We think solid, if slowing, job growth and persistent wage pressures should show sticky core inflation in next week’s February U.S. CPI data.

Germany’s planned fiscal boost and the U.S. starting to levy hefty tariffs are major policy shifts. Policy uncertainty and bond yield spikes pose risks to growth and stocks near term. We see more upward pressure on European and U.S. yields from sticky inflation and rising debt levels, even as lower U.S. yields suggest markets expect a typical Federal Reserve response to a downturn. Yet we think mega forces like AI can offset these drags on stocks, keeping us positive over six to 12 months.

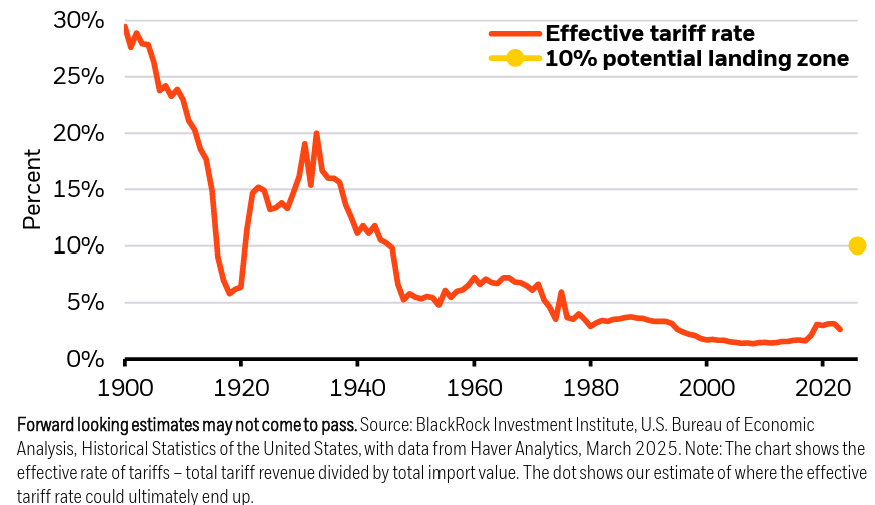

Return of tariff

U.S. effective tariff rate and potential 1900-2025

The U.S. briefly rolled out the largest tariffs in nearly a century on March 4: 25% tariffs on most Canadian and Mexican imports and an extra 10% on China. While most North American tariffs were later put on ice for another month, we think an average effective tariff rate of about 10% could be the eventual landing zone – with volatility along the way. See the chart. What matters more for near-term growth: any pain due to elevated uncertainty, including a potential U.S. government shutdown. Markets expect weaker U.S. growth to push the Fed to cut policy rates as in a typical business cycle. Yet we see a tough trade-off between supporting growth and curbing sticky inflation, limiting how much the Fed can cut. That reinforces our expectation of rates above pre-pandemic levels and higher bond yields. Germany’s plans for big defense and infrastructure spending mark a major fiscal policy shift.

Our scenarios framework – mapping potential outcomes for different mixes of growth, inflation and policy responses – helps us navigate this evolving market and economic landscape. In the past few weeks, markets have been increasingly pricing in a potential recession. We disagree. Why? Job creation has slowed slightly but the labor market remains strong in contrast to soft survey data showing declining consumer confidence. U.S. corporate earnings are also holding up. We still think earnings strength can broaden out beyond tech and to other regions as the buildout and adoption of artificial intelligence progresses. While heightened policy uncertainty will drive near-term market volatility, these other drivers keep us overweight U.S. stocks.

Long-term U.S. Treasuries have rallied as recession fears grip markets. Yet they don’t reliably buffer against equity selloffs given persistent inflation. And yields could spike suddenly. One reason: Higher-for-longer Fed policy rates and persistently large fiscal deficits – even with tariff revenue and spending cuts – could push investors to demand more compensation for the risk of holding long-term bonds. We stay underweight long-term Treasuries, preferring short-term notes for income.

This pressure on yields is global. German bunds suffered their sharpest selloff since 1990 after the parties set to lead Germany’s next government agreed to a €500 billion infrastructure fund and axed deficit limits on defense spending. These plans – to be voted in parliament next week – come as the U.S. says Europe is no longer a top security priority. The European Union also proposed amending its budget rules to up defense spending. Europe could face higher-for-longer rates like the U.S. as greater government borrowing and spending stoke inflation. Plus, the European Central Bank is nearing the end of rate cuts. That’s all why we think euro area sovereign bond yields can rise further and go underweight. We trim our underweight to Japanese government bonds: yields have surged to 16-year highs. Yet we still see room for JGB yields to keep rising in a world of elevated debt levels and higher inflation.

Bottom line: U.S. tariffs and Europe’s plans for a fiscal boost reinforce our expectation of higher-for-longer interest rates and bond yields. We go underweight euro area bonds. Policy uncertainty could keep weighing on U.S. stocks near term.

Market backdrop

The S&P 500 slid 3% last week, its biggest weekly drop in six months and dragging the index into negative territory for the year. Ten-year U.S. Treasury yields were flat on the week but about 50 basis points below the year’s high, while 10-year German bund yields jumped about 45 basis points last week – the largest surge since German reunification in 1990. U.S. payrolls data showing slower but still solid job gains suggests market concerns about a recession are overdone, in our view.

General disclosure:

This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The opinions expressed are as of March 10, 2025, and are subject to change without notice. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks. This information is not intended to be complete or exhaustive and no representations or warranties, either express or implied, are made regarding the accuracy or completeness of the information contained herein. This material may contain estimates and forward-looking statements, which may include forecasts and do not represent a guarantee of future performance. In the U.S. and Canada, this material is intended for public distribution. In EMEA, in the UK and Non-European Economic Area (EEA) countries: this is Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. In the European Economic Area (EEA): this is Issued by BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded. In Italy, for information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-rightavailable in Italian. In Switzerland, for qualified investors in Switzerland: This document is marketing material. Until 31 December 2021, this document shall be exclusively made available to, and directed at, qualified investors as defined in the Swiss Collective Investment Schemes Act of 23 June 2006 (“CISA”), as amended. From 1 January 2022, this document shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services (“FinSA”). For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa. For investors in Israel: BlackRock Investment Management (UK) Limited is not licensed under Israel’s Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”), nor does it carry insurance thereunder. In South Africa, please be advised that BlackRock Investment Management (UK) Limited is an authorized financial services provider with the South African Financial Services Board, FSP No. 43288. In the DIFC this material can be distributed in and from the Dubai International Financial Centre (DIFC) by BlackRock Advisors (UK) Limited — Dubai Branch which is regulated by the Dubai Financial Services Authority (DFSA). This material is only directed at ‘Professional Clients’ and no other person should rely upon the information contained within it. Blackrock Advisors (UK) Limited – Dubai Branch is a DIFC Foreign Recognised Company registered with the DIFC Registrar of Companies (DIFC Registered Number 546), with its office at Unit 06/07, Level 1, Al Fattan Currency House, DIFC, PO Box 506661, Dubai, UAE, and is regulated by the DFSA to engage in the regulated activities of ‘Advising on Financial Products’ and ‘Arranging Deals in Investments’ in or from the DIFC, both of which are limited to units in a collective investment fund (DFSA Reference Number F000738). In the Kingdom of Saudi Arabia, issued in the Kingdom of Saudi Arabia (KSA) by BlackRock Saudi Arabia (BSA), authorised and regulated by the Capital Market Authority (CMA), License No. 18-192-30. Registered under the laws of KSA. Registered office: 7976 Salim Ibn Abi Bakr Shaikan St, 2223 West Umm Al Hamam District Riyadh, 12329 Riyadh, Kingdom of Saudi Arabia, Tel: +966 11 838 3600. CR No, 1010479419. The information contained within is intended strictly for Sophisticated Investors as defined in the CMA Implementing Regulations. Neither the CMA or any other authority or regulator located in KSA has approved this information. In the United Arab Emirates this material is only intended for -natural Qualified Investor as defined by the Securities and Commodities Authority (SCA) Chairman Decision No. 3/R.M. of 2017 concerning Promoting and Introducing Regulations. Neither the DFSA or any other authority or regulator located in the GCC or MENA region has approved this information. In the State of Kuwait, those who meet the description of a Professional Client as defined under the Kuwait Capital Markets Law and its Executive Bylaws. In the Sultanate of Oman, to sophisticated institutions who have experience in investing in local and international securities, are financially solvent and have knowledge of the risks associated with investing in securities. In Qatar, for distribution with pre-selected institutional investors or high net worth investors. In the Kingdom of Bahrain, to Central Bank of Bahrain (CBB) Category 1 or Category 2 licensed investment firms, CBB licensed banks or those who would meet the description of an Expert Investor or Accredited Investors as defined in the CBB Rulebook. The information contained in this document, does not constitute and should not be construed as an offer of, invitation, inducement or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. In Singapore, this is issued by BlackRock (Singapore) Limited (Co. registration no. 200010143N). This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. In Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong. In South Korea, this material is for distribution to the Qualified Professional Investors (as defined in the Financial Investment Services and Capital Market Act and its sub-regulations). In Taiwan, independently operated by BlackRock Investment Management (Taiwan) Limited. Address: 28F., No. 100, Songren Rd., Xinyi Dist., Taipei City 110, Taiwan. Tel: (02)23261600. In Japan, this is issued by BlackRock Japan. Co., Ltd. (Financial Instruments Business Operator: The Kanto Regional Financial Bureau. License No375, Association Memberships: Japan Investment Advisers Association, The Investment Trusts Association, Japan, Japan Securities Dealers Association, Type II Financial Instruments Firms Association) for Institutional Investors only. All strategies or products BLK Japan offer through the discretionary investment contracts or through investment trust funds do not guarantee the principal amount invested. The risks and costs of each strategy or product we offer cannot be indicated here because the financial instruments in which they are invested vary each strategy or product. In Australia, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975 AFSL 230 523 (BIMAL). The material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. In New Zealand, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975, AFSL 230 523 (BIMAL) for the exclusive use of the recipient, who warrants by receipt of this material that they are a wholesale client as defined under the New Zealand Financial Advisers Act 2008. Refer to BIMAL’s Financial Services Guide on its website for more information. BIMAL is not licensed by a New Zealand regulator to provide ‘Financial Advice Service’ ‘Investment manager under an FMC offer’ or ‘Keeping, investing, administering, or managing money, securities, or investment portfolios on behalf of other persons’. BIMAL’s registration on the New Zealand register of financial service providers does not mean that BIMAL is subject to active regulation or oversight by a New Zealand regulator. In China, this material may not be distributed to individuals resident in the People’s Republic of China (“PRC”, for such purposes, not applicable to Hong Kong, Macau and Taiwan) or entities registered in the PRC unless such parties have received all the required PRC government approvals to participate in any investment or receive any investment advisory or investment management services. For Other APAC Countries, this material is issued for Institutional Investors only (or professional/sophisticated /qualified investors, as such term may apply in local jurisdictions). In Latin America, no securities regulator within Latin America has confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services is a regulated activity in Mexico thus is subject to strict rules