Policy uncertainty a risk to U.S. growth

Markets are doubting U.S. growth and equity strength. Yet economic conditions don’t signal a downturn. Resilient earnings keep us overweight U.S. stocks.

Global stocks trimmed their losses last week. The S&P 500 was down 1% after briefly entering a technical correction as recession fears gripped markets.

We expect the Federal Reserve to hold rates steady at this week’s policy meeting. Markets have been pricing in deeper rate cuts due to fears about U.S. growth. U.S. stocks slid as markets doubted the strength of U.S. growth and tech. We see a double disconnect. Economic conditions don’t point to recession, yet prolonged policy uncertainty may hurt growth. And the tech sector still has the strongest expected 2025 growth. We stay overweight U.S. stocks as policy uncertainty should ease over a six- to 12-month horizon. We don’t see long-term bonds as reliable portfolio diversifiers, even if growth suffers, given persistent deficits and inflation.

Economic strength.

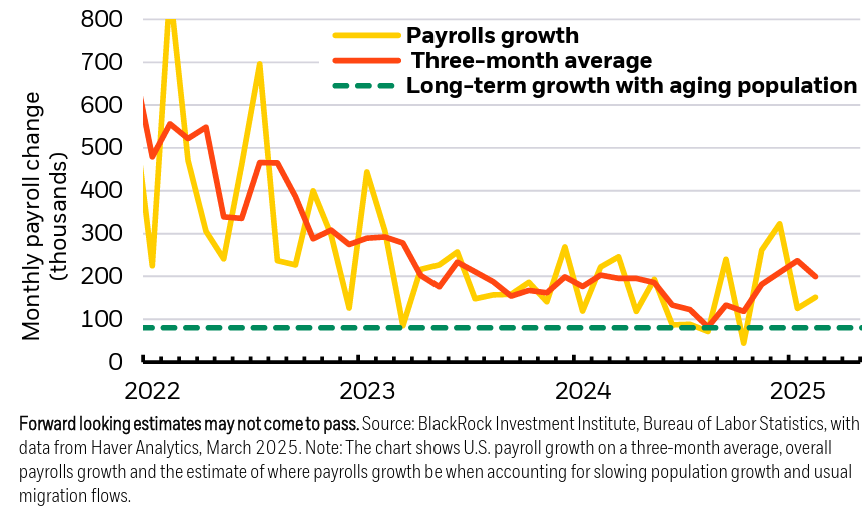

U.S payroll growth, actual and estimated 2022-2025

The S&P 500 has slid 8% from its February high and 4% this year as investors worry U.S. policy changes will bite growth that has been key to U.S. outperformance. Yet fundamental, quantitative economic data doesn’t indicate a downturn is near. Job gains have slowed since 2022 but remain above the long-term level we expect given an aging workforce. See the chart. U.S. corporate earnings expectations and high-frequency indicators of consumer health like weekly credit card spending are also solid, JPMorgan data show. Yet near-term risks to growth loom: Uncertainty could hit consumer spending, investment and trade. The longer policy uncertainty lasts, the more growth could suffer – but even that’s not certain. U.S. policy is spurring government spending elsewhere, reinforcing our view that developed market policy rates and bond yields will stay well above pre-pandemic levels.

Markets have also questioned U.S. equity strength, especially for the tech sector. U.S. recession fears reignited the selloff in tech stocks. The Nasdaq has fallen 11% from its all-time high hit in February – the biggest retreat since the 2022 equity selloff. Yet we stay overweight U.S. stocks on a six- to 12-month tactical horizon. Earnings expectations are healthy, with 12% growth forecast for the S&P 500 this year versus 14% last September, LSEG Datastream data show. Tech corporate margins, earnings and revenues forecasts are holding up and the sector still has the fastest expected growth this year. Free cash flow for the sector is also at 30% of total sales, the highest share since 1990 – a sign of current strength.

Recent volatility has been exacerbated by policy uncertainty and investors moving out of crowded positions. For example, last week saw a rapid move away from popular trades, like the tech-heavy momentum equity style factor that had some of its sharpest declines since the pandemic. Both could drive more volatility in the near term. But, over time, deleveraging will have run its course and uncertainty will likely ease as we get more policy implementation details, such as the White House’s full tariff plan due in April. Then, some of the risk premium investors now want for extreme uncertainty could be priced out again.

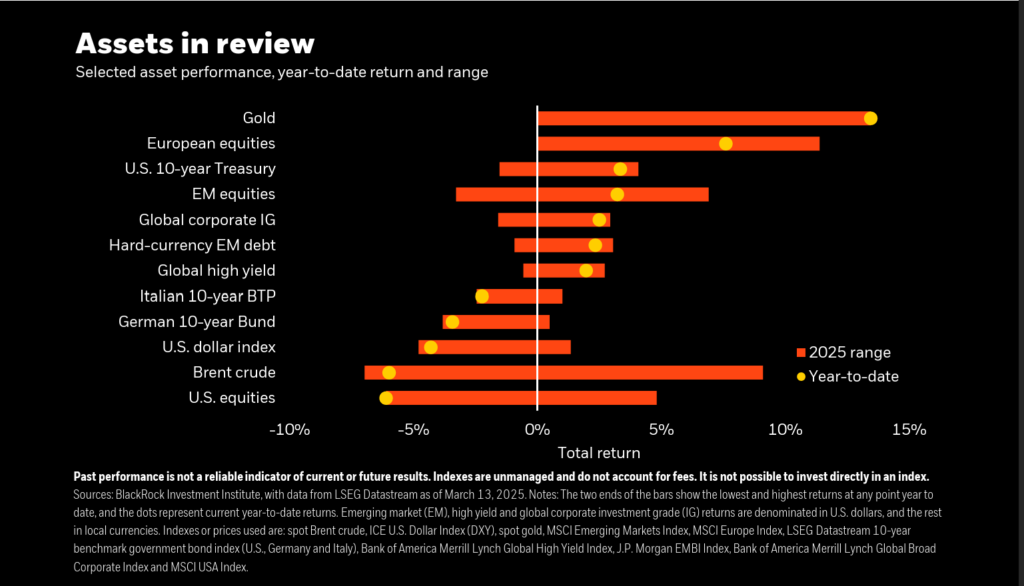

Long-term U.S. Treasuries have briefly buffered against the stock retreat. But their portfolio diversification role has weakened since the pandemic. We think yields can climb as investors demand more compensation, or term premium, for the risk of holding long-term bonds. Recent inflation data has been noisy, but core CPI is still above what’s consistent with the Federal Reserve’s 2% target. That limits how far the Fed will be able to cut. A likely rising U.S. fiscal deficit – even with revenue from tariffs and potential spending cuts – could also lead to higher term premium. In the past, investors saw long-term bonds as low risk even with heavy government debt loads because they believed low inflation and low interest rates were here to stay. But that fragile equilibrium has been disrupted. Germany’s plans to boost fiscal spending reinforce higher-for-longer rates – and bond yields – globally, we believe. We think gold could be a better diversifier than Treasuries in this environment.

Bottom line: We think the biggest risk to U.S. growth is prolonged policy uncertainty. U.S. stocks could face more near-term pressure, but we stay overweight on our tactical horizon. We stay underweight long-term Treasuries as we see yields rising.

Market backdrop

Global equity markets trimmed their losses last week after the S&P 500 briefly entered technical correction territory Thursday, falling 10% from the February record peak. The S&P 500 rebounded on Friday to end the week down 1%, but it has slid 4% for the year near six-month lows as concerns about U.S. tariffs and a U.S. recession gripped markets. Ten-year U.S. Treasury yields were largely steady last week near 4.30% even with the equity selloff and lower-than-expected CPI inflation data.

General disclosure:

This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The opinions expressed are as of March 17, 2025, and are subject to change without notice. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks. This information is not intended to be complete or exhaustive and no representations or warranties, either express or implied, are made regarding the accuracy or completeness of the information contained herein. This material may contain estimates and forward-looking statements, which may include forecasts and do not represent a guarantee of future performance. In the U.S. and Canada, this material is intended for public distribution. In EMEA, in the UK and Non-European Economic Area (EEA) countries: this is Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. In the European Economic Area (EEA): this is Issued by BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded. In Italy, for information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-rightavailable in Italian. In Switzerland, for qualified investors in Switzerland: This document is marketing material. Until 31 December 2021, this document shall be exclusively made available to, and directed at, qualified investors as defined in the Swiss Collective Investment Schemes Act of 23 June 2006 (“CISA”), as amended. From 1 January 2022, this document shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services (“FinSA”). For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa. For investors in Israel: BlackRock Investment Management (UK) Limited is not licensed under Israel’s Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”), nor does it carry insurance thereunder. In South Africa, please be advised that BlackRock Investment Management (UK) Limited is an authorized financial services provider with the South African Financial Services Board, FSP No. 43288. In the DIFC this material can be distributed in and from the Dubai International Financial Centre (DIFC) by BlackRock Advisors (UK) Limited — Dubai Branch which is regulated by the Dubai Financial Services Authority (DFSA). This material is only directed at ‘Professional Clients’ and no other person should rely upon the information contained within it. Blackrock Advisors (UK) Limited – Dubai Branch is a DIFC Foreign Recognised Company registered with the DIFC Registrar of Companies (DIFC Registered Number 546), with its office at Unit 06/07, Level 1, Al Fattan Currency House, DIFC, PO Box 506661, Dubai, UAE, and is regulated by the DFSA to engage in the regulated activities of ‘Advising on Financial Products’ and ‘Arranging Deals in Investments’ in or from the DIFC, both of which are limited to units in a collective investment fund (DFSA Reference Number F000738). In the Kingdom of Saudi Arabia, issued in the Kingdom of Saudi Arabia (KSA) by BlackRock Saudi Arabia (BSA), authorised and regulated by the Capital Market Authority (CMA), License No. 18-192-30. Registered under the laws of KSA. Registered office: 7976 Salim Ibn Abi Bakr Shaikan St, 2223 West Umm Al Hamam District Riyadh, 12329 Riyadh, Kingdom of Saudi Arabia, Tel: +966 11 838 3600. CR No, 1010479419. The information contained within is intended strictly for Sophisticated Investors as defined in the CMA Implementing Regulations. Neither the CMA or any other authority or regulator located in KSA has approved this information. In the United Arab Emirates this material is only intended for -natural Qualified Investor as defined by the Securities and Commodities Authority (SCA) Chairman Decision No. 3/R.M. of 2017 concerning Promoting and Introducing Regulations. Neither the DFSA or any other authority or regulator located in the GCC or MENA region has approved this information. In the State of Kuwait, those who meet the description of a Professional Client as defined under the Kuwait Capital Markets Law and its Executive Bylaws. In the Sultanate of Oman, to sophisticated institutions who have experience in investing in local and international securities, are financially solvent and have knowledge of the risks associated with investing in securities. In Qatar, for distribution with pre-selected institutional investors or high net worth investors. In the Kingdom of Bahrain, to Central Bank of Bahrain (CBB) Category 1 or Category 2 licensed investment firms, CBB licensed banks or those who would meet the description of an Expert Investor or Accredited Investors as defined in the CBB Rulebook. The information contained in this document, does not constitute and should not be construed as an offer of, invitation, inducement or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. In Singapore, this is issued by BlackRock (Singapore) Limited (Co. registration no. 200010143N). This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. In Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong. In South Korea, this material is for distribution to the Qualified Professional Investors (as defined in the Financial Investment Services and Capital Market Act and its sub-regulations). In Taiwan, independently operated by BlackRock Investment Management (Taiwan) Limited. Address: 28F., No. 100, Songren Rd., Xinyi Dist., Taipei City 110, Taiwan. Tel: (02)23261600. In Japan, this is issued by BlackRock Japan. Co., Ltd. (Financial Instruments Business Operator: The Kanto Regional Financial Bureau. License No375, Association Memberships: Japan Investment Advisers Association, The Investment Trusts Association, Japan, Japan Securities Dealers Association, Type II Financial Instruments Firms Association) for Institutional Investors only. All strategies or products BLK Japan offer through the discretionary investment contracts or through investment trust funds do not guarantee the principal amount invested. The risks and costs of each strategy or product we offer cannot be indicated here because the financial instruments in which they are invested vary each strategy or product. In Australia, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975 AFSL 230 523 (BIMAL). The material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. In New Zealand, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975, AFSL 230 523 (BIMAL) for the exclusive use of the recipient, who warrants by receipt of this material that they are a wholesale client as defined under the New Zealand Financial Advisers Act 2008. Refer to BIMAL’s Financial Services Guide on its website for more information. BIMAL is not licensed by a New Zealand regulator to provide ‘Financial Advice Service’ ‘Investment manager under an FMC offer’ or ‘Keeping, investing, administering, or managing money, securities, or investment portfolios on behalf of other persons’. BIMAL’s registration on the New Zealand register of financial service providers does not mean that BIMAL is subject to active regulation or oversight by a New Zealand regulator. In China, this material may not be distributed to individuals resident in the People’s Republic of China (“PRC”, for such purposes, not applicable to Hong Kong, Macau and Taiwan) or entities registered in the PRC unless such parties have received all the required PRC government approvals to participate in any investment or receive any investment advisory or investment management services. For Other APAC Countries, this material is issued for Institutional Investors only (or professional/sophisticated /qualified investors, as such term may apply in local jurisdictions). In Latin America, no securities regulator within Latin America has confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services is a regulated activity in Mexico thus is subject to strict rules.