AI a key driver of the power outlook

Expectations of rising power demand due partly to artificial intelligence (AI) are driving market volatility. We favor AI beneficiaries in utilities and infrastructure.

U.S. stocks rose last week, with mega cap tech headlining strong Q4 corporate earnings. Bond yields spiked on the hot U.S. CPI data but ended the week flat.

We get UK CPI this week. We think the UK’s weaker growth outlook paves the way for further Bank of England policy rate cuts.

We see structural shifts like AI transforming economies and driving energy demand. Case in point: 2024’s surge in typically dull utility stocks and other AI related companies. News of a seemingly more efficient AI model by China’s DeepSeek briefly interrupted this rally. We don’t see DeepSeek’s innovations hurting power demand, nor do the large AI builders. AI is one of many factors driving greater energy demand. We eye beneficiaries in utilities and infrastructure.

Buzz about utilities

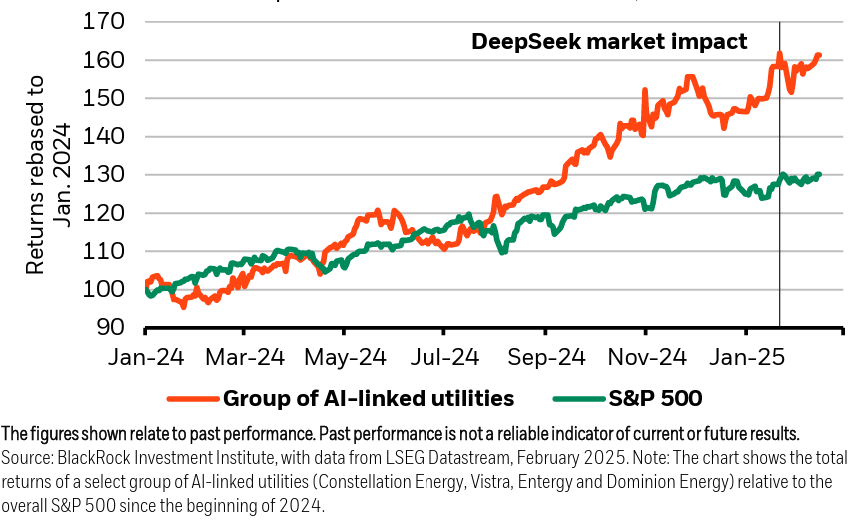

Returns for selected AI-exposed utilities versus the S&P 500, 2024-2025

We see a transformation underway potentially requiring investment on par with the industrial revolution. This can drive market volatility, as we have seen. One example: markets keying on AI’s power needs triggered a surge in AI-linked stocks last year, pushing the usually staid utilities sector higher. DeepSeek briefly challenged that trade last month on fears that heavy AI capex, and estimates of AI’s power needs, may be overdone. See the chart. Yet the selloff quickly reversed, a sign markets now share our view that while DeepSeek could deliver efficiency gains, new frontiers – like artificial general intelligence that matches or surpasses human abilities – will likely still require large investment. Plus, AI efficiency gains could accelerate the AI mega force, creating the need for more energy and the infrastructure to support it. That’s backed up by mega cap tech’s plans to stick with and even increase AI capex.

In the U.S., where AI is shaping up to be a key driver of new power demand, estimates of the scale of the nation’s total power needs are huge and growing. Q4 corporate earnings season shows the mega cap tech companies driving the AI buildout are largely sticking with their AI capex, even after the DeepSeek news. Some are even increasing on last year’s spend – Meta, Amazon, Microsoft and Alphabet are expected to invest nearly $320 billion in AI capex this year, up roughly 40% from 2024, according to company guidance. The AI buildout could drive power demands further afield, too: many governments are joining U.S. companies in their AI commitments – as seen in the $500 billion U.S. Stargate project and the European Union’s €200 billion AI bet announced in Paris last week.

Yet AI is only part of a broader trend of growing power needs globally. Other drivers include rising global incomes, reshoring, industrial growth and building cooling needs. Extreme heat is driving air conditioning use, particularly in emerging markets where it is not yet widespread. Electrification of buildings and vehicles is expanding, though unevenly across regions. We expect speedbumps as soaring demand runs up against power supply constraints, potentially adding to inflation pressures. This calls for upping allocations to equities, infrastructure and inflation-linked bonds as an inflation hedge, we think.

Assessing what type of power will meet this spiking power demand is key, we think. Already huge investment expected in the energy transition could grow further, in our view. The companies driving the AI buildout prefer power supplies that are always on, cost-effective, immediately available and low carbon, a difficult combination. That could drive U.S. demand for natural gas and renewables. Yet we still see a role for traditional energy as policymakers seek affordable and reliable power alongside low-carbon goals. Longer term, demand could rise for nuclear and other low-carbon, available-when-needed energy sources. We eye investment opportunities across power generation, grid infrastructure and the electrical equipment value chain. We like utilities and power producers in this environment and get granular to identify opportunities along the supply chain.

Bottom line: We see soaring power demand driving bouts of market volatility. We get active to find investment opportunities – like in utilities, grids and electrical equipment supply chains – and value selectivity as performance dispersion grows.

Market backdrop

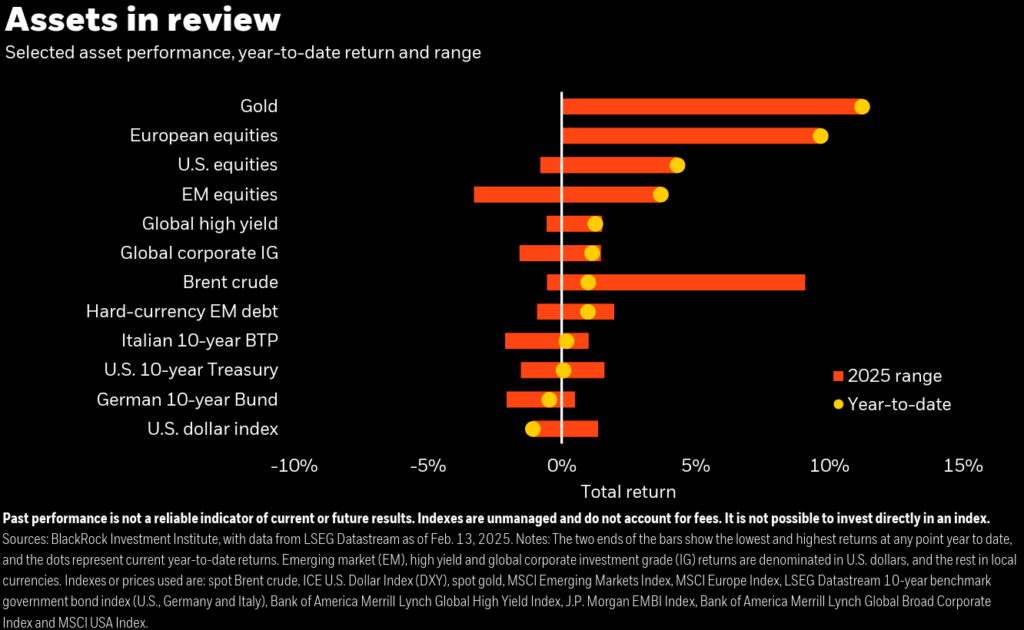

U.S. stocks rose last week, taking the year’s gains to 4%. Yet they again lagged European shares – now up 9% this year, led by financials. Q4 earnings season stayed strong on solid results and AI capex guidance by mega cap tech. U.S. CPI pointed to sticky inflation, causing U.S. 10-year Treasury yields to spike before settling back near 4.47%. Persistent inflation reduces the odds of more Federal Reserve rate cuts this year, we think. Hong Kong-listed Chinese shares surged largely on AI optimism.

General disclosure:

This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The opinions expressed are as of Feb. 18, 2025, and are subject to change without notice. Reliance upon information in this material is at the sole discretion of the reader. Investing involves risks. This information is not intended to be complete or exhaustive and no representations or warranties, either express or implied, are made regarding the accuracy or completeness of the information contained herein. This material may contain estimates and forward-looking statements, which may include forecasts and do not represent a guarantee of future performance. In the U.S. and Canada, this material is intended for public distribution. In EMEA, in the UK and Non-European Economic Area (EEA) countries: this is Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. In the European Economic Area (EEA): this is Issued by BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded. In Italy, for information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-rightavailable in Italian. In Switzerland, for qualified investors in Switzerland: This document is marketing material. Until 31 December 2021, this document shall be exclusively made available to, and directed at, qualified investors as defined in the Swiss Collective Investment Schemes Act of 23 June 2006 (“CISA”), as amended. From 1 January 2022, this document shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services (“FinSA”). For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa. For investors in Israel: BlackRock Investment Management (UK) Limited is not licensed under Israel’s Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”), nor does it carry insurance thereunder. In South Africa, please be advised that BlackRock Investment Management (UK) Limited is an authorized financial services provider with the South African Financial Services Board, FSP No. 43288. In the DIFC this material can be distributed in and from the Dubai International Financial Centre (DIFC) by BlackRock Advisors (UK) Limited — Dubai Branch which is regulated by the Dubai Financial Services Authority (DFSA). This material is only directed at ‘Professional Clients’ and no other person should rely upon the information contained within it. Blackrock Advisors (UK) Limited – Dubai Branch is a DIFC Foreign Recognised Company registered with the DIFC Registrar of Companies (DIFC Registered Number 546), with its office at Unit 06/07, Level 1, Al Fattan Currency House, DIFC, PO Box 506661, Dubai, UAE, and is regulated by the DFSA to engage in the regulated activities of ‘Advising on Financial Products’ and ‘Arranging Deals in Investments’ in or from the DIFC, both of which are limited to units in a collective investment fund (DFSA Reference Number F000738). In the Kingdom of Saudi Arabia, issued in the Kingdom of Saudi Arabia (KSA) by BlackRock Saudi Arabia (BSA), authorised and regulated by the Capital Market Authority (CMA), License No. 18-192-30. Registered under the laws of KSA. Registered office: 7976 Salim Ibn Abi Bakr Shaikan St, 2223 West Umm Al Hamam District Riyadh, 12329 Riyadh, Kingdom of Saudi Arabia, Tel: +966 11 838 3600. CR No, 1010479419. The information contained within is intended strictly for Sophisticated Investors as defined in the CMA Implementing Regulations. Neither the CMA or any other authority or regulator located in KSA has approved this information. In the United Arab Emirates this material is only intended for -natural Qualified Investor as defined by the Securities and Commodities Authority (SCA) Chairman Decision No. 3/R.M. of 2017 concerning Promoting and Introducing Regulations. Neither the DFSA or any other authority or regulator located in the GCC or MENA region has approved this information. In the State of Kuwait, those who meet the description of a Professional Client as defined under the Kuwait Capital Markets Law and its Executive Bylaws. In the Sultanate of Oman, to sophisticated institutions who have experience in investing in local and international securities, are financially solvent and have knowledge of the risks associated with investing in securities. In Qatar, for distribution with pre-selected institutional investors or high net worth investors. In the Kingdom of Bahrain, to Central Bank of Bahrain (CBB) Category 1 or Category 2 licensed investment firms, CBB licensed banks or those who would meet the description of an Expert Investor or Accredited Investors as defined in the CBB Rulebook. The information contained in this document, does not constitute and should not be construed as an offer of, invitation, inducement or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. In Singapore, this is issued by BlackRock (Singapore) Limited (Co. registration no. 200010143N). This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. In Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong. In South Korea, this material is for distribution to the Qualified Professional Investors (as defined in the Financial Investment Services and Capital Market Act and its sub-regulations). In Taiwan, independently operated by BlackRock Investment Management (Taiwan) Limited. Address: 28F., No. 100, Songren Rd., Xinyi Dist., Taipei City 110, Taiwan. Tel: (02)23261600. In Japan, this is issued by BlackRock Japan. Co., Ltd. (Financial Instruments Business Operator: The Kanto Regional Financial Bureau. License No375, Association Memberships: Japan Investment Advisers Association, The Investment Trusts Association, Japan, Japan Securities Dealers Association, Type II Financial Instruments Firms Association) for Institutional Investors only. All strategies or products BLK Japan offer through the discretionary investment contracts or through investment trust funds do not guarantee the principal amount invested. The risks and costs of each strategy or product we offer cannot be indicated here because the financial instruments in which they are invested vary each strategy or product. In Australia, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975 AFSL 230 523 (BIMAL). The material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. In New Zealand, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975, AFSL 230 523 (BIMAL) for the exclusive use of the recipient, who warrants by receipt of this material that they are a wholesale client as defined under the New Zealand Financial Advisers Act 2008. Refer to BIMAL’s Financial Services Guide on its website for more information. BIMAL is not licensed by a New Zealand regulator to provide ‘Financial Advice Service’ ‘Investment manager under an FMC offer’ or ‘Keeping, investing, administering, or managing money, securities, or investment portfolios on behalf of other persons’. BIMAL’s registration on the New Zealand register of financial service providers does not mean that BIMAL is subject to active regulation or oversight by a New Zealand regulator. In China, this material may not be distributed to individuals resident in the People’s Republic of China (“PRC”, for such purposes, not applicable to Hong Kong, Macau and Taiwan) or entities registered in the PRC unless such parties have received all the required PRC government approvals to participate in any investment or receive any investment advisory or investment management services. For Other APAC Countries, this material is issued for Institutional Investors only (or professional/sophisticated /qualified investors, as such term may apply in local jurisdictions). In Latin America, no securities regulator within Latin America has confirmed the accuracy of any information contained herein. The provision of investment management and investment advisory services is a regulated activity in Mexico thus is subject to strict rules.